ML Brain Asset Allocation Insight - September

2024/9/9

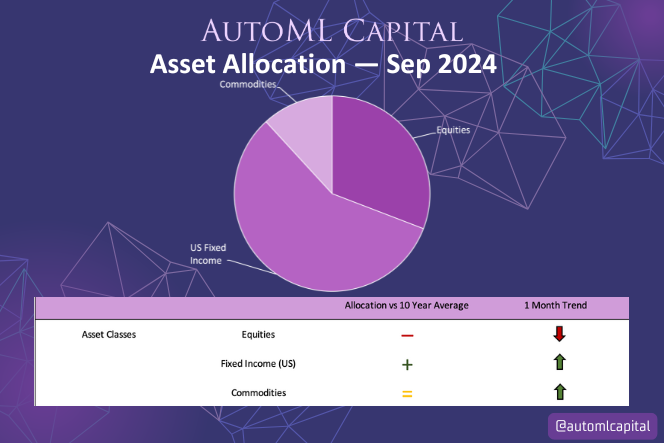

In September, our ML Brain Core Solution adjusted its portfolio with a notable shift towards fixed income and commodities while reducing equity exposure. This reallocation was driven by heightened market volatility and concerns over rising interest rates.

As equity markets have faced downward pressure, our increased focus on U.S. real estate stocks reflects a preference for more defensive assets that can offer stability during periods of market stress. U.S. Fixed Income now constitutes the largest portion of our portfolio, representing more than half of our total allocation. Commodities saw the most significant increase, now comprising 11.83% of the portfolio. By increasing our exposure to commodities and fixed income, we aim to capitalize on these market dynamics and provide a hedge against inflationary pressures.

Disclaimer: This post is intended for informational purposes only and should not be considered as financial or investment advice. The content provided is not tailored to individual circumstances and should not be regarded as a personal recommendation. It is important to exercise your own judgment and consult with qualified professionals before making any investment decisions.