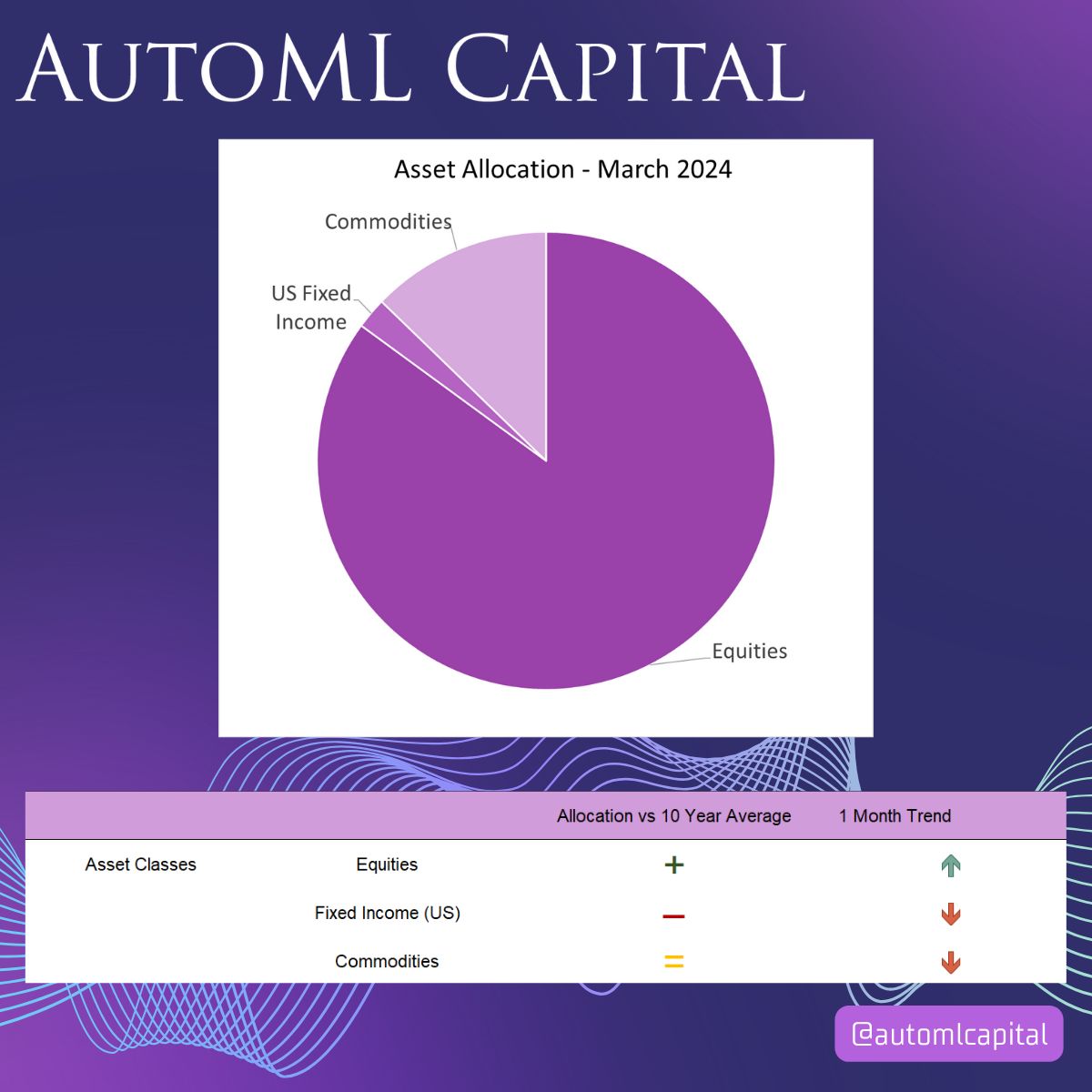

ML Brain Asset Allocation Insight - March 2024

2024/03/08

As we enter the beginning of March 2024, ML Brain has made decisions regarding its portfolio. Equities continue to hold the highest percentage, surpassing last month's allocation. Commodities follow closely behind, while the lowest allocation is towards US fixed income. Both US fixed income and commodities have decreased compared to the previous month.

When examining specific asset categories, the ML Brain portfolio currently holds a larger proportion of Japanese stocks compared to its 10-year average. This is due to the anticipation of significant growth in Japan's stock market, driven by global economic expansion and impactful stock market reforms. In general, the portfolio has reduced its allocation to US fixed income. Additionally, ML Brain has chosen to increase its allocation to gold this month.

Disclaimer: This post is meant to provide information and should not be considered as financial or investment advice. The material presented here is not customized for your specific situation and should not be seen as a personal recommendation. It is important to use your own judgment and consult with qualified professionals before making any investment decisions.