ML Brain Asset Allocation Insight - January 2024

2024/1/9

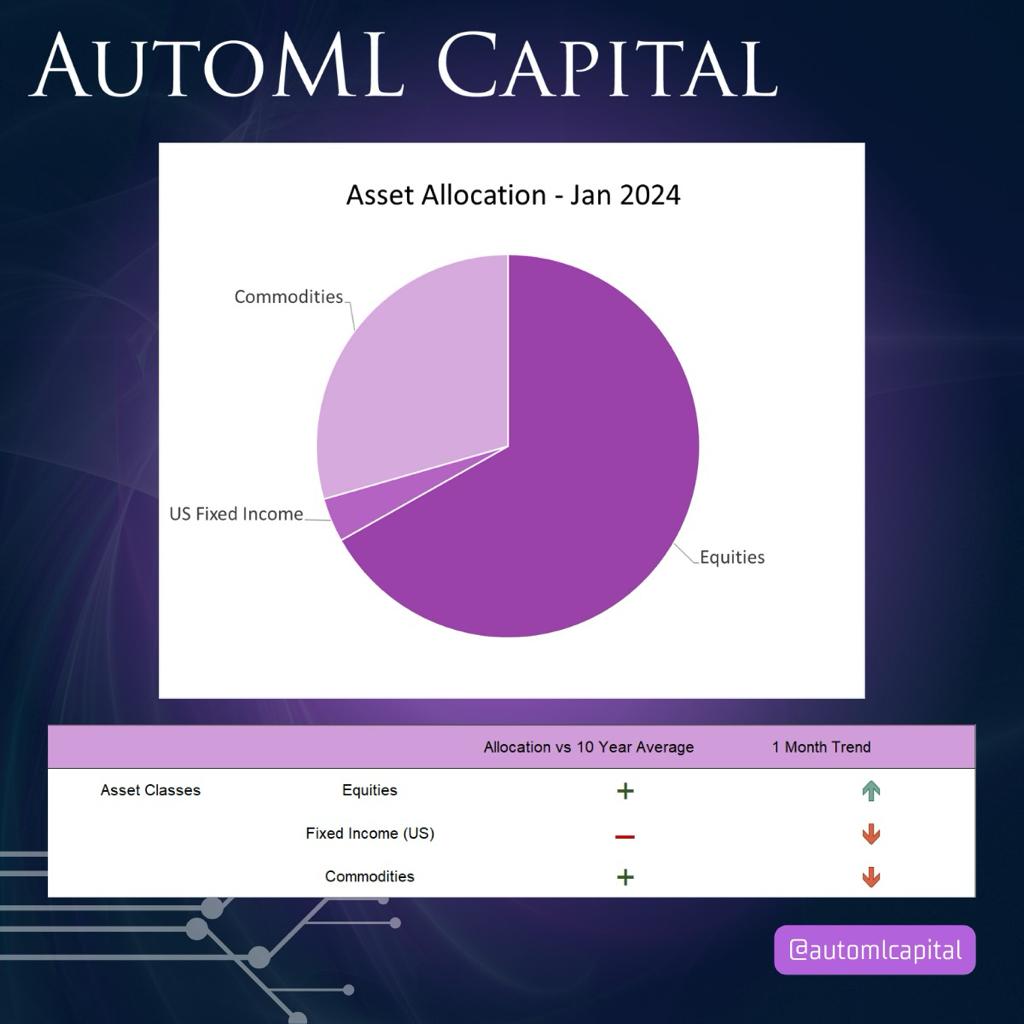

In the beginning of January 2024, ML Brain made adjustments to its portfolio. During this month, equities reached the highest percentage, followed by commodities, and the lowest allocation was towards US fixed income.

The Equity and commodities sections of the ML Brain Portfolio are higher than their 10-year averages. However, there has been a decrease in commodities compared to last month. Compared to December, ML Brain specifically decided to reduce the allocation to Inflation-linked assets. The portfolio is also heavily weighted towards equities.

When examining specific asset categories, the ML Brain portfolio currently holds a more significant proportion of Japanese stocks than its 10-year average. In general, the portfolio has reduced its allocation to US stocks. Across most regions, the allocation to assets has either exceeded expectations or remained stable. ML Brain has chosen to allocate less to gold this month, although it still holds a higher amount than the 10-year average.

Disclaimer: This post is meant to provide information and should not be considered financial or investment advice. The material presented here is not customized for your situation and should not be considered a personal recommendation. It is essential to use your judgment and consult with qualified professionals before making any investment decisions.