ML Brain Asset Allocation Insight - February 2024

2024/2/6

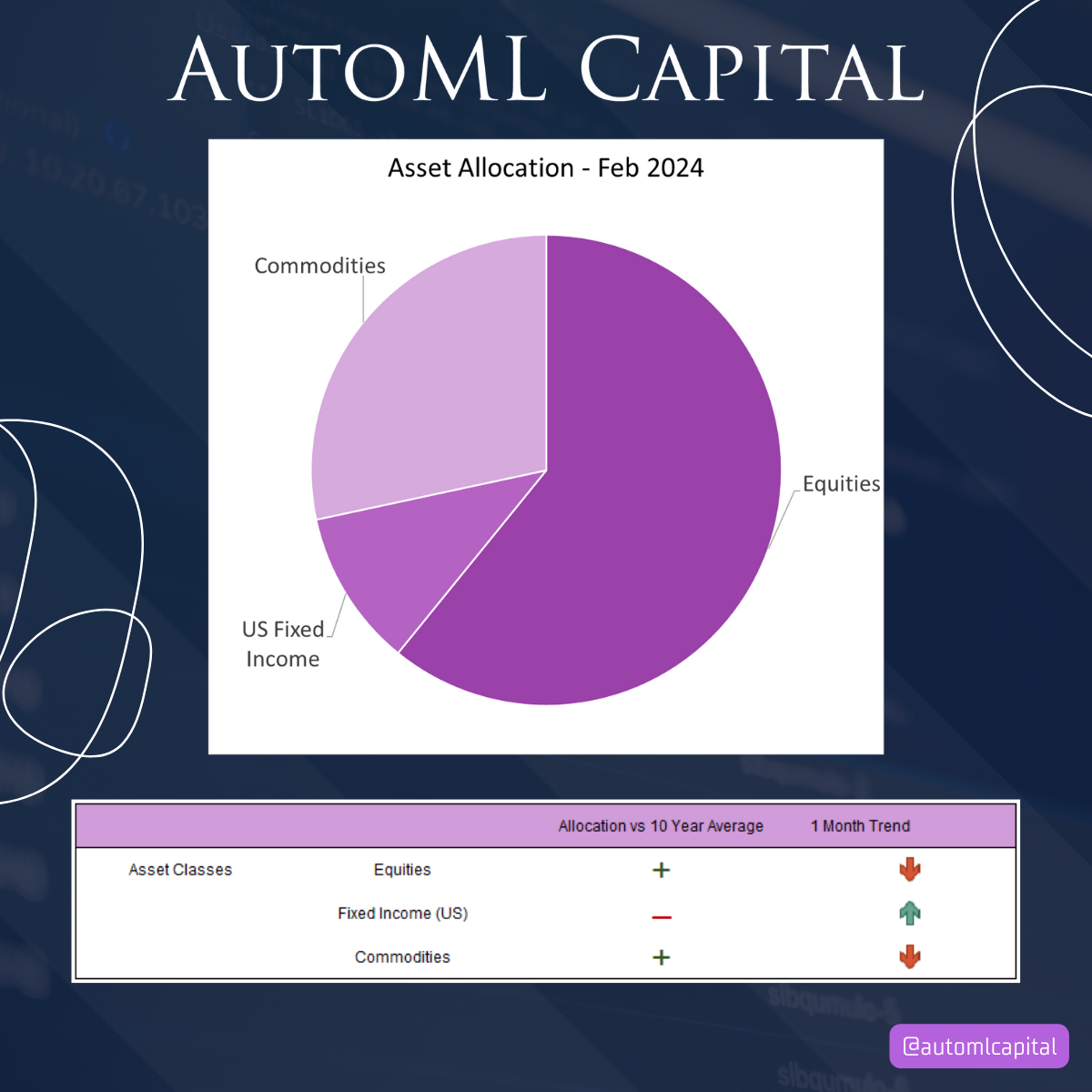

In February, ML Brain adjusted its portfolio composition, reducing allocations to equities and commodities compared with January. Conversely, there was an increase in the overall allocation to US fixed income.

The equity and commodities components of the ML Brain Portfolio continue to surpass their 10-year averages, mirroring the position held in the previous month. The portfolio's stance on inflation-linked assets remains unchanged from January, with no holdings in this category. Despite these adjustments, the portfolio maintains a significant emphasis on equities.

A closer examination of specific asset categories reveals a notable decrease in investments in Japanese stocks and emerging markets. Conversely, there has been an upturn in the allocation towards US stocks, now holding a larger share than the 10-year average. This month, the allocation to gold has been dialed back, with no holding, falling below its 10-year average. Nonetheless, ML Brain has opted to increase its holdings in physical commodities, suggesting a diversification within the tangible asset space.

Disclaimer: This post is meant to provide information and should not be considered as financial or investment advice. The material presented here is not customized for your specific situation and should not be seen as a personal recommendation. It is important to use your own judgment and consult with qualified professionals before making any investment decisions.