ML Brain Asset Allocation Insight - April 2024

2024/04/05

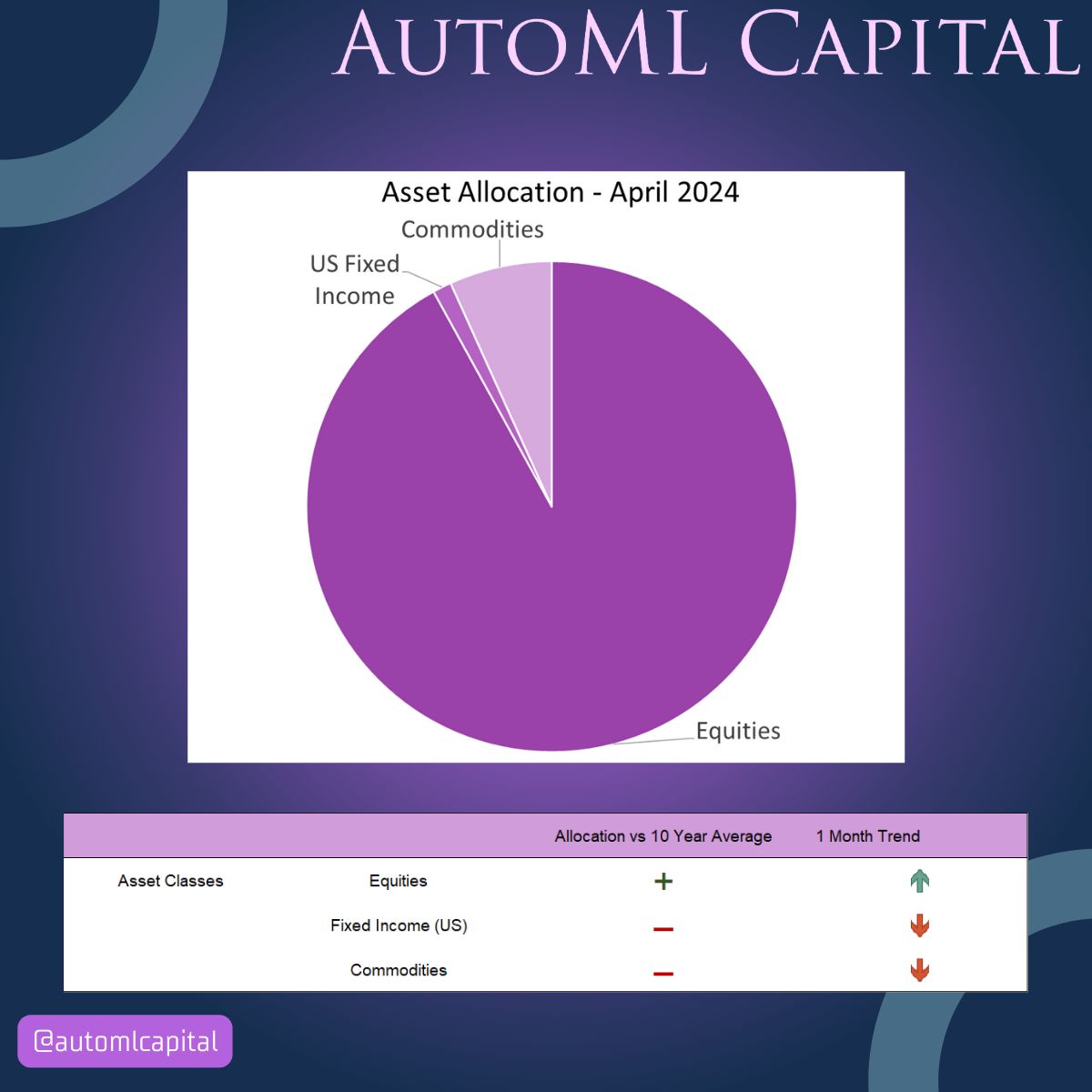

As April 2024 unfolds, our asset allocation remains largely consistent with the previous month, with equities reaching the highest percentage, followed by commodities, and then US fixed income as the smallest percentage.

Regarding specific asset categories, the ML Brain portfolio currently holds a larger proportion of US stocks. However, due to recent volatility influenced by a mix of economic indicators and regulatory updates, ML Brain has decreased its holdings in specific US sectors, such as technology. Additionally, ML Brain has increased its holdings in European equities. In other regions, the allocation to assets has either exceeded expectations or remained stable. ML Brain continues to decrease its holdings in US fixed income and commodities this month.

Disclaimer: This post is meant to provide information and should not be considered as financial or investment advice. The material presented here is not customized for your specific situation and should not be seen as a personal recommendation. It is important to use your own judgment and consult with qualified professionals before making any investment decisions.